Your Partner

in Legal Success

| Reading Time: 6 Minutes

TAX LAW

Would you like to listen to our content regarding Tax Law? Click below:

Tax Law is a branch of law within the scope of Financial Law. It deals with disputes and problems arising from the tax relationship between the state and individuals. Almost everyone knows the general meaning of the word “tax“. The meaning of tax is clear to everyone, whether they are taxpayers or not. Taxes are mandatory payments to the government.

Tax definitions have changed in direct proportion to the functions imposed on the tax. According to one definition, tax is a compulsory contribution to the service of public authority by separating it from the existence of a person or group of persons. According to another definition, a tax is an obligation a government body imposes for public purposes.

The independence of Tax Law has been the subject of different debates in the past. However, today, it is accepted as an independent branch of law with its institutions and concepts. Tax Law is a branch of science or discipline that examines the formal and substantive legal rules related to resolving tax-related disputes and the principles and theories on which these rules are based from positive and normative perspectives.

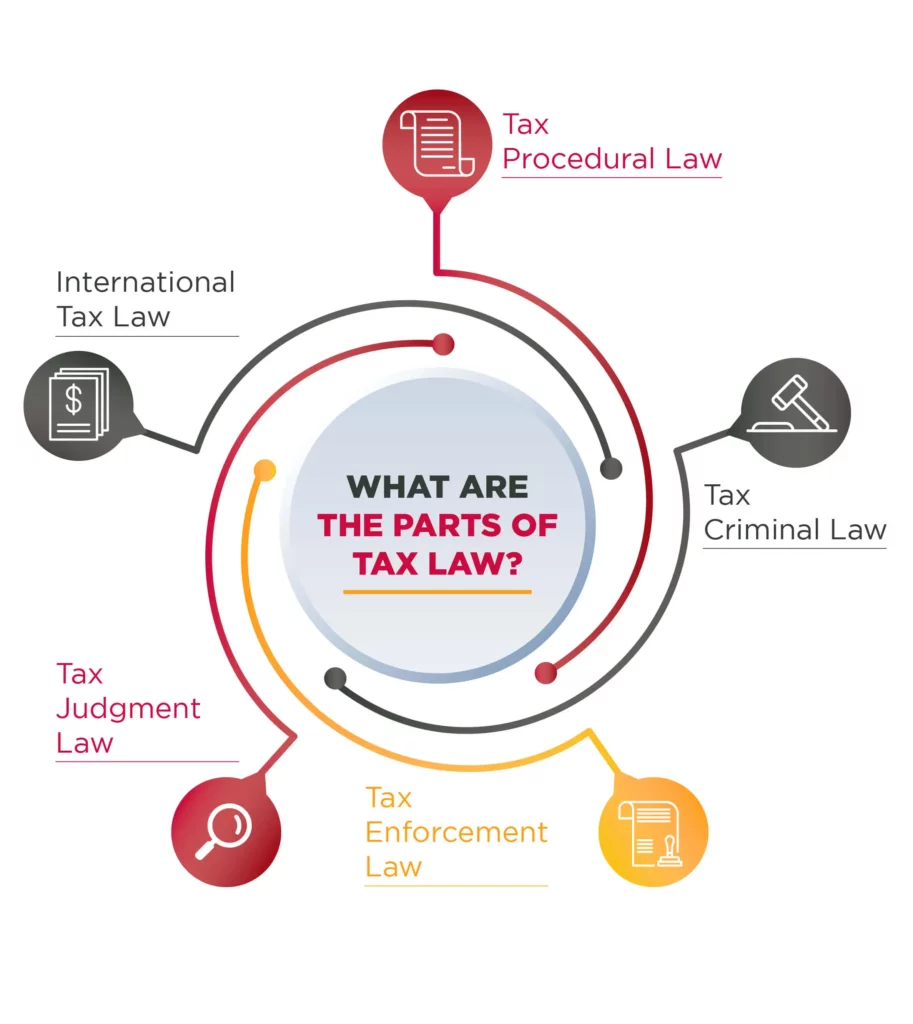

What Are The Parts of Tax Law?

Tax Law, which is related to various branches of law, including Administrative Law, Constitutional Law, Criminal Law, Private Law, and International Law, is divided into four according to its scope: General Tax Law, Private Tax Law, Material Tax Law, and Formal Tax Law.

The divisions of Tax Law according to their subjects are as follows:

- Tax Procedural Law,

- Tax Criminal Law,

- Tax Enforcement Law,

- Tax Judgment Law,

- International Tax Law.

What is General Tax Law and Private Tax Law?

General Tax Law is the section where the general concepts, institutions, and principles of Tax Law are examined. Private Tax Law is the section in which all taxes in the tax system are examined separately and one by one.

What is Material Tax Law and Form Tax Law?

The most important factor constituting the Material Tax Law is the principles and rules regarding the birth and abolition of tax claims. The rules regarding the administrative and judicial resolution of tax disputes also constitute Formal Tax Law. These rules are tax techniques and include the date, notification, accrual, and collection transactions.

What is Tax Procedural Law?

The rules that show how the individuals who make up the society will demand and prove their rights arising from their relations with each other in the legal order are called Procedural Law. The tax relationship, which expresses a legal relationship between the individual and the state, is also tied to a series of procedural rules.

The Tax Procedure Law, which consists of the rules governing the acquisition, use, and performance of rights and duties arising from the tax relationship, covers the taxation principles, the duties of the taxpayer, the determination of the tax receivable, the taxation process and the administrative procedures involved in this process.

It can be stated that the Tax Procedure Law is largely identical to the General and Formal Tax Law since the rules regarding Tax Procedure Law, including tax disputes and jurisdiction, are applied to all taxes included in the tax system, except for special provisions.

What is Tax Criminal Law?

Criminal Law, a branch of Public Law that disrupts the social order, shows the illegal acts and the sanctions to be applied to those who commit these acts. Illegal acts are called crimes, and the sanctions applied to their perpetrators are called punishment. Penal sanctions are also applied to violations of Tax Laws.

Acts that cause damage or the danger of harming the state treasury are acts that require tax penalties. These acts are usually met with monetary sanctions of administrative and financial nature and sometimes with sanctions in the sense of Criminal Law. Tax Criminal Law has developed as a sub-division of Tax Law, with the effect of the peculiar structure of tax crimes.

What is Tax Enforcement Law?

The branch of law, which consists of the rules regarding creditors obtaining their receivables through public power, is called Enforcement and Bankruptcy Law, or Enforcement Law. Tax Enforcement Law, which regulates the payment of tax receivables in case the taxpayers do not pay their tax debt, is a branch consisting of the rules regarding the collection of public revenues obtained by the state based on its sovereign right by using legal force.

What is Tax Litigation Law?

Proceedings Law is a branch of law that regulates the courts’ procedures while performing their judicial duties. Proceedings Law is divided into sections such as Civil Procedure Law, Criminal Procedure Law, Administrative Judgment Law, and Tax Judgment Law. The rules regarding settling disputes arising from applying tax laws constitute the subject of Tax Jurisdiction Law.

What is International Tax Law?

International Law, a branch of law consisting of the rules of law regulating international relations, accepts equality at the international level by limiting the sovereignty of states that have relations with each other. International tax relations and treaties regulating these relations constitute the subject of International Tax Law. It also includes regulating the relations of states with other states with their own Tax Laws, unilaterally, apart from international tax treaties.

What Are MGC Legal’s Tax Law Services?

With extensive experience, MGC Legal assists individuals and businesses in all areas of Tax Law with its Tax Law Service. It offers litigation, reconciliation, representation, and consultancy services in tax and legal disputes in the best possible way. Its first-class services in terms of quality and quantity enable its clients to make the right business or personal finance choices. MGC Legal has extensive knowledge of Tax Law and has sufficient knowledge and experience in business and financial strategies.

Incorporating all the other skills required to practice Tax Law successfully, MGC Legal makes it possible for its clients to take advantage of the full Tax Law Services in Turkey. Resource transfers, inter-company transactions, transactions with shareholders-style sourced from special operations, tax disputes, tax planning, and Tax Law ensure the legal aspects of the legislation are the most important guideline support.

What Are The Skills of MGC Legal Tax Law Staff?

Knowing how to synthesize complex laws and express themselves effectively both orally and in writing, MGC Legal staff are successful in their careers with the following additional skills:

- Accounting and Mathematics Skills,

- Communication Skill,

- Critical Thinking and Analysis Skills,

- Research Skills.

Lawyers and attorneys interested in Tax Law acquire all these skills in law school. They gain math or accounting skills through undergraduate courses. Tax Law lawyers and attorneys need to have a solid understanding of both. Despite the complexity of Tax Law, it is also important that Tax Lawyers and attorneys know how to explain it in plain and understandable language and clearly articulate their writing and speaking skills to assist their clients in their decision-making. The ability to read laws and jurisprudence and analyze and apply these laws accurately according to the situation of their clients is also of great importance. Tax Law is constantly changing, so lawyers and attorneys need strong research skills to provide up-to-date advice to their clients.

Conclusion: Our Tax Law Services in Turkey

Tax Law services in Turkey are essential for individuals and businesses alike, as the country’s laws can be complex and challenging. Taxation is a crucial aspect of the Turkish economy, accounting for a significant portion of the government’s revenue. As such, staying compliant with the latest regulations and guidelines is important to avoid legal issues and financial penalties.

Professional Tax Law Services in Turkey can help individuals and businesses understand their tax obligations and ensure compliance with the latest regulations. From tax planning and preparation to filing tax returns and resolving disputes with tax authorities, MGC Legal’s Tax Law Services provide expert guidance and support throughout the process. With the help of experienced professionals, you can maximize your tax benefits, minimize your tax liabilities, and avoid costly legal pitfalls.

Overall, Tax Law Services in Turkey is an essential tool for anyone looking to navigate the complexities of the country’s laws. Whether you’re an individual taxpayer or a business owner, seeking the guidance of a qualified Tax Law Professional in Turkey can help you achieve your financial goals and ensure compliance with the latest regulations.

Keywords: Tax Law Attorney in Turkey, Tax Law Attorney in Istanbul, Tax Law Lawyer in Turkey, Tax Law Lawyer in Istanbul, Tax Law Consultant in Turkey, Tax Law Consultant in Istanbul, Tax Attorney in Turkey, Tax Attorney in Istanbul, Tax Lawyer in Turkey, Tax Lawyer in Istanbul, Tax Consultant in Turkey, Tax Consultancy in Turkey, Tax Law Consultant in Turkey, Tax Law Consultancy in Turkey, Tax Consultant in Istanbul, Tax Consultancy in Istanbul, Tax Law Consultant in Istanbul, Tax Law Consultancy in Istanbul, Tax Services in Turkey, Tax Services in Istanbul, Tax Specialist in Turkey, Tax Specialist in Istanbul, Tax Law Specialist in Turkey, Tax Law Specialist in Istanbul, Tax Law in Turkey, Tax Law Services in Turkey, Tax Law Firm in Turkey, Tax Law Office in Istanbul, Tax Law Office in Turkey, Tax Guidance in Turkey, Tax Guidance in Istanbul, Tax Professional in Istanbul, Tax Professional in Turkey, Tax Helper in Turkey, Tax Helper in Istanbul.